Categories

Tags

-

#Cheese Industry

#Cheese Industry Share

#Cheese Industry Size

#Cheese Industry News

#Essential Oils Industry

#Essential Oils Industry Share

#Essential Oils Industry Demand

#Essential Oils Industry Analysis

#Canned Seafood Industry

#Canned Seafood Industry Share

#Canned Seafood Industry Size

#Canned Seafood Industry News

#Organic Coffee Industry

#Organic Coffee Industry Analysis

#Organic Coffee Industry Cagr

#Organic Coffee Industry News

#Pet Food Industry

#Pet Food Industry Share

#Pet Food Industry Opportunities

#Pet Food Industry Forecast

#Champagne Industry

#Champagne Industry Share

#Champagne Industry Size

#Champagne Industry News

#Dried Herbs Industry

#Dried Herbs Industry Share

#Dried Herbs Industry Size

#Dried Herbs Industry Dried Herbs Industry News

#Baby Food Industry

#Baby Food Industry Demand

#Baby Food Industry Growth

#Baby Food Industry Business

#Lipid Nutrition Industry

#Lipid Nutrition Industry Share

#Lipid Nutrition Industry Business

#Lipid Nutrition Industry Growth

#Lipid Nutrition Industry Demand

#Kimchi Industry

#Kimchi Industry Size

#Kimchi Industry Share

#Kimchi Industry Growth

#Kimchi Industry Demand

#Fresh Herbs Industry

#Fresh Herbs Industry Share

#Fresh Herbs Industry Size

#Fresh Herbs Industry Demand

#Fresh Herbs Industry Growth

#Green Tea Industry

#Green Tea Industry Share

#Green Tea Industry Size

#Green Tea Industry Demand

#Ginger Industry

#Ginger Industry Insights

#Ginger Industry Share

#Ginger Industry Size

#Ginger Industry News

#Wheat Germ Oil Industry

#Wheat Germ Oil Industry Trends

#Wheat Germ Oil Industry Insights

#Wheat Germ Oil Industry Growth

#Low Fat Yogurt Industry

#Low Fat Yogurt Industry Size

#Low Fat Yogurt Industry Trends

#Low Fat Yogurt Industry Insights

#Low Fat Yogurt Industry Growth

#Chocolate Industry

#Chocolate Industry Business

#Chocolate Industry Growth

#Chocolate Industry Demand

#Chocolate Industry Trends

#Konjac Industry

#Konjac Industry Share

#Konjac Industry Size

#Konjac Industry Business

#Konjac Industry News

#Ethiopia Spice Industry

#Ethiopia Spice Industry Share

#Ethiopia Spice Industry Size

#Ethiopia Spice Industry Trends

#Ethiopia Spice Industry Demand

#Argan Oil Industry

#Argan Oil Industry Insights

#Argan Oil Industry News

#Argan Oil Industry Growth

#Chocolate industry Share

#Chocolate industry Size

#Rice Seeds Industry

#Rice Seeds Industry Forecast

#Rice Seeds Industry Analysis

#Rice Seeds Industry Opportunities

#Colostrum Industry

#Colostrum Industry Demand

#Colostrum Industry Growth

#Colostrum Industry Business

#Yeast Industry

#Yeast Industry Share

#Yeast Industry Size

#Yeast Industry Growth

#Ethiopia Spices Industry

#Ethiopia Spices Industry Share

#Ethiopia Spices Industry Size

#Ethiopia Spices Industry Demand

#Ethiopia Spices Industry Growth

#Maize Bran industry

#Maize Bran industry Share

#Maize Bran industry Size

#Maize Bran industry Business

#Maize Bran industry News

#IQF Fruits Industry

#IQF Fruits Industry Size

#IQF Fruits Industry Share

#IQF Fruits Industry growth

#IQF Fruits Industry Insights

#Nuts Industry

#Nuts Industry Share

#Nuts Industry Size

#Nuts Industry Demand

#Nuts Industry News

#Ginger Industry Cagr

#Ginger Industry Forecast

#Ginger Industry Opportunities

#Ginger Industry Analysis

#Organic Sugar Industry

#Organic Sugar Industry Demand

#Organic Sugar Industry Growth

#Organic Sugar Industry Share

#Organic Sugar Industry Trends

#Matcha Industry

#Matcha Industry Share

#Matcha Industry Size

#Matcha Industry Insights

#Matcha Industry Trends

#Millet Industry

#Millet Industry Share

#Millet Industry Size

#Millet Industry Growth

#Potato Chips Industry

#Potato Chips Industry Insights

#Potato Chips Industry Share

#Potato Chips Industry Size

#Pizza Box Industry

#Pizza Box Industry Share

#Pizza Box Industry Size

#Pizza Box Industry Demand

#Pizza Box Industry Growth

#Collagen Peptide Industry

#Collagen Peptide Industry Share

#Collagen Peptide Industry Size

#Collagen Peptide Industry Demand

#Collagen Peptide Industry Growth

#Smoothie Industry

#Smoothie Industry Analysis

#Smoothie Industry Opportunities

#Smoothie Industry Forecast

#Smoothie Industry Size

#Smoothie Industry Share

#Smoothie Industry Growth

#Amaranth Industry

#Amaranth Industry Size

#Amaranth Industry Share

#Amaranth Industry News

Archives

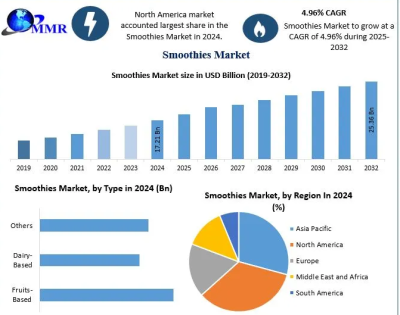

Smoothies Industry Size, Share Analysis, and 2032 Forecast

-

Posted by preeti mmr Filed in Other #Smoothie Industry #Smoothie Industry Analysis #Smoothie Industry Opportunities #Smoothie Industry Forecast 14 views

Market Estimation & Definition

The Smoothies Industry was valued at approximately USD 17.21 billion in 2024, and it is projected to expand at a compound annual growth rate (CAGR) of 4.96 percent from 2025 to 2032, ultimately reaching nearly USD 25.36 billion. This sector encompasses fruit-, dairy-, and other ingredient-based smoothies distributed through restaurants, supermarkets, smoothie bars, convenience stores, and other channels.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/121502/

Market Growth Drivers & Opportunities

The market’s expansion is anchored by rising global health and fitness awareness, including the role of smoothies in weight-loss and general wellness. Consumers increasingly seek ready-to-eat beverages that are nutritious, portable, and hydrating, especially as they retain dietary fiber compared to fruit juices. Moreover, the appeal of local and tropical flavors and novel ingredients, such as erythritol, further spurs demand.

What Lies Ahead: Emerging Trends Shaping the Future

Health trends are tilting toward “green smoothies”, combining fruits and leafy greens like spinach, kale, chard, and collards, favored by health-conscious consumers for their digestive and immune-boosting benefits. On the distribution front, restaurants currently lead with a 67 percent share in 2024, followed by supermarkets with a 55 percent share, reflecting strong institutional and retail traction. Packaging trends—ranging from plastic and glass to paper—are also evolving to align with environmental and convenience demands.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/121502/

Segmentation Analysis

By Type:

-

Fruits-based smoothies dominate, accounting for 79 percent of market share in 2024; organic varieties are included under this umbrella, while dairy-based versions are growing at a faster clip—projected at 7.6 percent CAGR through 2032.

By Distribution Channel:

-

Restaurants lead with 67 percent share, projecting robust growth.

-

Supermarkets also play a major role with 55 percent share, followed by smoothie bars and convenience stores.

Additional segmentation includes packaging material (plastic, paper, glass, others) and geographic breakdowns.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/121502/

Country-Level Analysis: United States & Germany

-

United States: North America leads globally, with the U.S. accounting for 45 percent share in 2024. The U.S. smoothies market is expected to grow notably, driven by busy lifestyles, high health awareness, and convenience food demand.

-

Germany: As a major European market, Germany is projected to expand at around 5 percent CAGR during the 2025–2032 period.

Key Players:

1. Barfresh Food Group, Inc.

2. Bolthouse Farms, Inc.

3. Boost Juice (Australia)

4. Crussh Fit Food & Juice Bar

5. Ella's Kitchen (Brands) Ltd

6. Innocent Ltd.

7. Jamba Juice Company

8. Maui Wowi Hawaiian Coffees & Smoothies

9. Naked Juice Company

10. Orange Julius of America

11. Planet Smoothie

12. Red Mango, Inc.

13. Robeks Fresh Juices & Smoothies

14. Smoothie King Franchises, Inc.

15. Surf City SqueezeConclusion

In summary, the global smoothies industry is poised for sustained growth—projected to climb from USD 17.21 billion in 2024 to USD 25.36 billion by 2032, propelled by rising health awareness, convenient ready-to-drink options, and flavorful innovation. With fruits-based smoothies dominating the landscape, dairy-based versions also offer high-velocity opportunity. The U.S. and Germany emerge as key country markets, while competitive dynamics and regional strategies shape the future. Brands that align with consumer preferences for nutrition, sustainability, and convenience are well-positioned to lead in the evolving smoothies market.

About UsMaximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.Contact Maximize Market ResearchMAXIMIZE MARKET RESEARCH PVT. LTD.2nd Floor, Navale IT park Phase 3,Pune Banglore Highway, NarhePune, Maharashtra 411041, India.+91 9607365656sales@maximizemarketresearch.com -