Categories

Tags

-

#Global Robotics Market

#Europe Automotive Robotics Market

#United States Automotive Robotics Market

#United States Home Decor Market

#Medical Ceramics Market

#Intraocular Lens Market

#Global Tilapia Market

#Global Pasta Market

#Europe Fertilizer Market

#China Baby Food Market

#China Autonomous Vehicles Market

#United States Smart TV Market

#United States Energy Drink Market

#United States Cheese Market

#Global Protein Ingredients Market

#Global Neonatal Intensive Care Market

#Milk Powder Market

#United States Video Game Market

#Global Yeast Market

#Automotive Robotics Market

#Flavoured Milk Market

#Global Plywood Market

#Global Spinal Fusion Device Market

#Hip Replacement Market

#Egg Powder Market

#Specialty Fertilizers Market

#Autoimmune Disease Diagnostics Market

#Global Orthodontics Market

#Global Catheter Market

#Saudi Arabia Chocolate Market

#Saudi Arabia Perfume Market

#Halal Cosmetics Market

#Air Conditioners Market

#Myocardial Infarction Market

#China Energy Drink Market

#https://www.renub.com/milk-powder-market-p.php

#Global E-commerce Market

#China Ice Cream Market

#https://www.renub.com/vacuum-insulation-panel-market-p.php

#Ready to Drink Tea and Coffee Market

#Japan Outbound Tourism Market

#China Vaccine Market

Archives

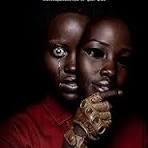

United States Movie Market Size Forecast Report 2024-2032

-

United States Movie Market Outlook

The United States movie market is projected to reach approximately US$26.92 billion by 2030, as reported by Renub Research. Movie theaters are venues that typically feature multiple screens, allowing for simultaneous showings of various films or events. These theaters provide a rich entertainment experience, accommodating large audiences and offering a wide selection of viewing options. With advancements in technology, many venues now boast state-of-the-art audio-visual systems, comfortable seating, and diverse concession offerings.

In the U.S., theaters have transformed the cinema experience, providing comfort and variety under one roof. The convenience of multiple screenings in one location appeals to audiences, who can enjoy modern amenities like plush seating and cutting-edge sound and visuals. As social hubs, cinemas create communal spaces for entertainment, and their strategic locations, extensive film selections, and focus on customer experience have solidified their status as preferred destinations for moviegoers across America.

The U.S. movie market is expected to grow at a CAGR of 7.62% from 2024 to 2030.

Theaters have evolved to deliver immersive experiences through technologies such as 3D, IMAX, and Dolby Atmos. They provide a shared social experience for families and friends. Growth in disposable incomes has increased access to movie tickets and concessions, while shifting consumer preferences towards experiences over possessions have further fueled the industry. Movie chains are consolidating to enhance their market presence, expanding into underserved areas, and introducing premium formats like IMAX and Dolby Cinema. The continued popularity of blockbuster franchises contributes to ticket sales, which are also bolstered by the appeal of premium formats that command higher ticket prices.

Cinemas are continuously adapting to offer unique and immersive experiences, incorporating premium formats, luxurious amenities, and enhanced food and beverage options. The market is increasingly leveraging data analytics for content personalization, tailoring film recommendations and services to target audience preferences. Additionally, investments in digitalization are on the rise, with theaters adopting advanced ticketing systems, online marketing strategies, and e-commerce initiatives to boost customer engagement. This comprehensive approach positions cinemas as modern entertainment hubs, blending technology, luxury, and personalized experiences to ensure captivating cinematic outings.

Furthermore, traditional theaters are strategically partnering with streaming platforms and content creators to adapt to changing consumer preferences and the rise of streaming services. These collaborations foster innovative distribution methods and co-productions, ensuring exclusive releases and maintaining competitiveness. Notable examples include AMC Theatres’ partnership with Universal Pictures, Cinemark’s exclusive pre-release screenings with WarnerMedia, Alamo Drafthouse Cinema’s collaboration with Neon for independent films, and Fathom Events’ various partnerships for unique content. These alliances enhance revenue through shared agreements, broaden content offerings, attract new audiences, diversify income streams, and bolster the resilience of theaters amidst industry fluctuations. As of 2023, the U.S. movie market was valued at US$16.10 billion.

Revenue Streams in U.S. Movie Market

Movie ticket sales are the primary revenue stream in the U.S. movie market. The market can be categorized into several income sources: ticket sales, advertising revenue, food and beverage sales, and others. The dominance of ticket sales stems from the consistent demand for cinematic experiences, with audiences seeking the latest releases, blockbusters, and a variety of films. This revenue is supported by strategic pricing, targeted screenings, and promotional campaigns. Despite the rise of streaming services, the allure of the big screen and the social, immersive aspects of cinema ensure that ticket sales remain the cornerstone of financial success in the evolving entertainment landscape.

Screen Type Preferences

The U.S. movie market is segmented by screen type into Digital Non-3D, Digital 3D, and others. Digital non-3D screenings continue to dominate as a primary revenue source, appealing to a broad audience and providing a quality viewing experience without the premium pricing of 3D. With most films available in this format, non-3D screenings cater to diverse preferences and budget-conscious viewers, ensuring steady demand. Despite technological advancements, this traditional format remains a staple, highlighting its lasting popularity and financial significance in American cinema.

Demographic Trends

The U.S. movie market is witnessing significant growth among the female demographic. Traditionally, cinemas have expanded their offerings to include a variety of genres that resonate with female audiences. The rise of female-centric films and empowering storytelling has increased female attendance, with theaters actively creating inclusive environments through comfortable seating and improved facilities. Collaborative industry initiatives promoting gender diversity and representation are reshaping the cinematic landscape, recognizing and embracing the growing influence of female viewers.

Additionally, the 18-24 age group is experiencing remarkable growth in attendance. This demographic, known for its enthusiasm for social experiences and entertainment, is drawn to the diverse cinematic offerings available. Blockbusters and genre-spanning films, along with innovative viewing experiences, appeal to the tech-savvy preferences of this age group. Recognizing their importance, cinemas are employing strategic marketing, digital engagement, and loyalty programs to attract this significant and expanding segment.

Regional Insights

California leads the U.S. movie market, fueled by its large population and a strong presence of the 18-24 age group. The state’s urbanization concentrates moviegoers in major cities, creating a robust consumer base with high disposable income. As the entertainment industry hub, California benefits from its proximity to Hollywood and the technological innovations of Silicon Valley. Despite market saturation, fierce competition drives established chains to invest in premium features and diverse content. California's cinema culture is vibrant, catering to varied tastes, bolstered by favorable regulations and labor policies that enhance its market dominance.

Related Report:

United States Desalination Market

Key Players

The U.S. movie market is primarily dominated by key players such as Cinemark Holding, Inc., Regal Cinemas, CGV Cinemas, AMC Theatres, Marcus Theatres, B&B Theatres, and Empire Cinema.

In December 2022, AMC Theatres partnered with Zoom to create a hybrid meeting experience, designating 17 theaters in the U.S. as dedicated Zoom Rooms. This collaboration merges the comfort and capacity of movie theaters with Zoom's video conferencing technology, providing businesses with a unique venue for meetings and conferences, complete with high-quality audio and video, comfortable seating, and large screens capable of accommodating up to 150 participants.

Distribution Income – Market breakup from 4 viewpoints:

1. Income from the sale of movie tickets

2. Advertisement Income

3. Sale of Food & Beverages

4. Others

Screen Type – Market breakup from 3 viewpoints:

1. Digital non -3D

2. Digital 3D

3. Others

Gender – Market breakup from 2 viewpoints:

1. Male

2. Female

Age-Group – Market breakup from 7 viewpoints:

1. Age Group 2-11

2. Age Group 12-17

3. Age Group 18-24

4. Age Group 25-39

5. Age Group 40-49

6. Age Group 50-59

7. Age Group 60 plus

States – Market breakup from 38 viewpoints:

1. Alabama

2. Arizona

3. California

4. Colorado

5. Connecticut

6. Florida

7. Georgia

8. Idaho

9. Illinois

10. Indiana

11. Iowa

12. Kansas

13. Maine

14. Maryland

15. Massachusetts

16. Michigan

17. Minnesota

18. Mississippi

19. Missouri

20. Nebraska

21. Nevada

22. New Hampshire

23. New Jersey

24. New York

25. North Carolina

26. Ohio

27. Oregon

28. Pennsylvania

29. Rhode Island

30. South Carolina

31. South Dakota

32. Tennessee

33. Texas

34. Utah

35. Virginia

36. Washington

37. Wyoming

38. Others

All companies have been covered from 3 viewpoints:

• Overview

• Recent Developments

• Revenue

Company Analysis:

1. Cinemark Holding, Inc.

2. Regal Cinemas

3. CGV Cinemas

4. AMC Theatres

5. Marcus Theatres

6. B&B Theatres

7. AMC

8. Empire Cinema

About the Company:

Renub Research is a Market Research and Information Analysis company with more than 15 years of experience in Research, Survey, and Consulting. Our research helps companies to take business decisions: on strategy, organization, operations, technology, mergers & acquisitions, etc. Till now we have published more than 9000 syndicated reports and worked on more than 750 custom research projects. Currently, we are supplying data to EMIS, Bloomberg, Thomson Reuters, etc. We support many blue-chip companies by providing them with findings and perspectives across a wide range of markets.