Categories

Tags

Archives

Surge Arrester Market Report Provide Recent Trends, Opport

-

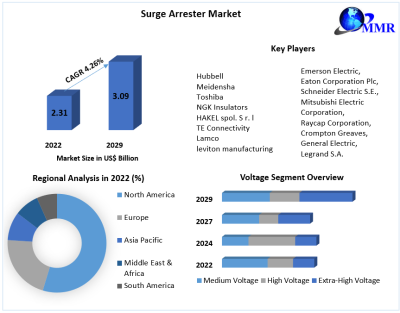

Surge Arrester Market size is expected to reach US$ 3.09 Bn. by 2029, growing at a CAGR of 4.26% during the forecast period.

1. Market Size

· 2023 Market Value: USD 3.8 billion

· 2030 Forecast Value: USD 5.9 billion

· CAGR (2024–2030): ~6.5%

This steady growth is propelled by global utility modernization, digital substation rollout, and demand for reliable power.

2. Overview

Surge arresters — including polymer- and porcelain-housed — are vital components that protect electrical infrastructure from over-voltage events caused by lightning strikes and switching surges. With smart and hybrid designs now available, they play a critical role in safeguarding transmission, distribution, industrial systems, and renewable energy assets.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/25312/

3. Market Estimation & Definition

The surge arrester market comprises:

· Housing Material: Polymer (increasing) and traditional porcelain

· Voltage Classes: Low, medium, and high-voltage systems

· Product Types: Line-mounted, station-class, distribution, and protection-class arresters

· End Users: Utilities, industrial facilities, rail networks, telecom, renewable power plants

These devices support asset longevity, help prevent outages, and maintain grid resilience.

4. Market Growth Drivers & Opportunities

· Grid Modernization: Rising demand for smart substations and digital asset integration

· Climate Impact: Increased frequency of lightning and storms boosts arrester deployment

· Renewable Integration: Wind and solar farms require distribution-level protection

· Material Innovation: Polymer-enclosed arresters provide better performance and durability

· Regulatory Measures: Standards mandating protective devices in substations and industrial assets

· Maintenance & Service Models: Remote-monitoring enabled surge arresters support predictive maintenance

5. Segmentation Analysis

By Housing Material:

· Porcelain: Established, high-voltage applications

· Polymer: Fastest-growing segment due to lightweight, maintenance ease, and humidity resistance

By Voltage Class:

· Low-Voltage Arresters: Used in residential and distribution-level systems

· Medium-Voltage Arresters: Widely implemented across utilities and commercial operations

· High-Voltage Arresters: Essential for utility-scale transmission and substations

By Product Type:

· Line-Mounted Arresters protect overhead line equipment

· Station-Class Arresters safeguard transformer and switchgear houses

· Protection-Class Units serve industrial and specialized applications

By End-Use Sector:

· Utilities: Largest sector due to volume and grid protection needs

· Industrial: High asset-value sites requiring protective infrastructure

· Renewables: Wind and solar farms across medium-voltage networks

· Rail & Transportation: Power system surge protection

· Telecom & Data Centers: Ensuring uptime and infrastructure safety

6. Major Manufacturers

Leading producers shaping the market:

· Siemens Energy

· ABB

· Eaton Power Quality

· Schneider Electric

· Mersen

· General Electric

· Toshiba Transmission & Distribution

· CG Power

· Hyosung Power & Industrial Systems

· Zhejiang Youyuan Electric

These companies lead through smart arrester products, global reach, and after-sales service.

7. Regional Analysis

· Asia‑Pacific: Market leader due to rapid power infrastructure expansion and growing renewable adoption

· North America: Strong market driven by grid resilience and storm-related protection needs

· Europe: High demand from industrial, utility, and decarbonization initiatives

· Latin America: Moderate growth tied to grid renewals and digital substations

· Middle East & Africa: Investment in utility and telecom infrastructure fueling arrester deployment

8. Country-Level Analysis

· China & India: Leading adopters due to vast utility-scale and industrial surge protection requirements

· United States & Canada: Focused on smart grid and extreme weather resilience

· Germany & UK: Growth in rail electrification and utility smart substation projects

· Brazil & Mexico: Distribution-level upgrades and new power projects driving arrester demand

· UAE/Saudi Arabia/South Africa: Infrastructure expansion, renewable hubs, and utilities modernization

9. COVID‑19 Impact Analysis

The pandemic briefly slowed component production in early 2020, but since then the surge arrester market has rebounded strongly. Growth in smart-grid upgrades, utility resilience initiatives, and remote monitoring solutions has accelerated demand.

10. Competitor (Commutator) Analysis

Market Structure:

Moderately consolidated – global OEMs dominate high-voltage arrester space; regional players focus on distribution and retrofit segments.Strategic Trends:

· Growth in polymer-housed and hybrid arresters

· Integration of remote monitoring and surge counters

· Partnerships with utilities and renewables developers

· Lifecycle service contracts for predictive maintenance

Challenges:

· Price volatility in raw materials (EPDM, silicone, porcelain)

· Competitive low-cost products in distribution segments

· Regulatory compatibility across regions

Opportunities:

· Retrofitting smart-grid installations

· Expanding arrester use in wind/solar farms

· Integrating surge protection into IoT-enabled substation assets

· Long-energy absorption polymer arresters for HVDC and EHV systems

11. Key Questions Answered

Question

Answer

What’s the current market size?

USD 3.8 billion in 2023

What’s the forecast for 2030?

USD 5.9 billion

What is the expected CAGR?

~6.5%

Which housing material is fastest-growing?

Polymer-based arresters

Which sector uses them most?

Utilities, transmission, and distribution

Who are the major manufacturers?

Siemens, ABB, Eaton, Schneider, GE, Toshiba

Which region leads the market?

Asia‑Pacific

How did COVID impact the sector?

Short supply disruption, followed by robust recovery

12. Press Release Conclusion

The global surge arrester market is set for healthy growth through 2030, driven by smart-grid rollouts, renewable energy expansion, and climate-driven infrastructure protection needs. As utilities and asset owners invest in modern, monitored arrester solutions—particularly polymer-based, medium-voltage units—vendors offering smart, durable, and service-driven products are best positioned to win market share. Surge arresters will remain critical for grid reliability, resilience, and digital transformation in the years to come.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com