Categories

Tags

-

#Cheese Industry

#Cheese Industry Share

#Cheese Industry Size

#Cheese Industry News

#Essential Oils Industry

#Essential Oils Industry Share

#Essential Oils Industry Demand

#Essential Oils Industry Analysis

#Canned Seafood Industry

#Canned Seafood Industry Share

#Canned Seafood Industry Size

#Canned Seafood Industry News

#Organic Coffee Industry

#Organic Coffee Industry Analysis

#Organic Coffee Industry Cagr

#Organic Coffee Industry News

#Pet Food Industry

#Pet Food Industry Share

#Pet Food Industry Opportunities

#Pet Food Industry Forecast

#Champagne Industry

#Champagne Industry Share

#Champagne Industry Size

#Champagne Industry News

#Dried Herbs Industry

#Dried Herbs Industry Share

#Dried Herbs Industry Size

#Dried Herbs Industry Dried Herbs Industry News

#Baby Food Industry

#Baby Food Industry Demand

#Baby Food Industry Growth

#Baby Food Industry Business

#Lipid Nutrition Industry

#Lipid Nutrition Industry Share

#Lipid Nutrition Industry Business

#Lipid Nutrition Industry Growth

#Lipid Nutrition Industry Demand

#Kimchi Industry

#Kimchi Industry Size

#Kimchi Industry Share

#Kimchi Industry Growth

#Kimchi Industry Demand

#Fresh Herbs Industry

#Fresh Herbs Industry Share

#Fresh Herbs Industry Size

#Fresh Herbs Industry Demand

#Fresh Herbs Industry Growth

#Green Tea Industry

#Green Tea Industry Share

#Green Tea Industry Size

#Green Tea Industry Demand

#Ginger Industry

#Ginger Industry Insights

#Ginger Industry Share

#Ginger Industry Size

#Ginger Industry News

#Wheat Germ Oil Industry

#Wheat Germ Oil Industry Trends

#Wheat Germ Oil Industry Insights

#Wheat Germ Oil Industry Growth

#Low Fat Yogurt Industry

#Low Fat Yogurt Industry Size

#Low Fat Yogurt Industry Trends

#Low Fat Yogurt Industry Insights

#Low Fat Yogurt Industry Growth

#Chocolate Industry

#Chocolate Industry Business

#Chocolate Industry Growth

#Chocolate Industry Demand

#Chocolate Industry Trends

#Konjac Industry

#Konjac Industry Share

#Konjac Industry Size

#Konjac Industry Business

#Konjac Industry News

#Ethiopia Spice Industry

#Ethiopia Spice Industry Share

#Ethiopia Spice Industry Size

#Ethiopia Spice Industry Trends

#Ethiopia Spice Industry Demand

#Argan Oil Industry

#Argan Oil Industry Insights

#Argan Oil Industry News

#Argan Oil Industry Growth

#Chocolate industry Share

#Chocolate industry Size

#Rice Seeds Industry

#Rice Seeds Industry Forecast

#Rice Seeds Industry Analysis

#Rice Seeds Industry Opportunities

#Colostrum Industry

#Colostrum Industry Demand

#Colostrum Industry Growth

#Colostrum Industry Business

#Yeast Industry

#Yeast Industry Share

#Yeast Industry Size

#Yeast Industry Growth

#Ethiopia Spices Industry

#Ethiopia Spices Industry Share

#Ethiopia Spices Industry Size

#Ethiopia Spices Industry Demand

#Ethiopia Spices Industry Growth

#Maize Bran industry

#Maize Bran industry Share

#Maize Bran industry Size

#Maize Bran industry Business

#Maize Bran industry News

#IQF Fruits Industry

#IQF Fruits Industry Size

#IQF Fruits Industry Share

#IQF Fruits Industry growth

#IQF Fruits Industry Insights

#Nuts Industry

#Nuts Industry Share

#Nuts Industry Size

#Nuts Industry Demand

#Nuts Industry News

#Ginger Industry Cagr

#Ginger Industry Forecast

#Ginger Industry Opportunities

#Ginger Industry Analysis

#Organic Sugar Industry

#Organic Sugar Industry Demand

#Organic Sugar Industry Growth

#Organic Sugar Industry Share

#Organic Sugar Industry Trends

#Matcha Industry

#Matcha Industry Share

#Matcha Industry Size

#Matcha Industry Insights

#Matcha Industry Trends

#Millet Industry

#Millet Industry Share

#Millet Industry Size

#Millet Industry Growth

#Potato Chips Industry

#Potato Chips Industry Insights

#Potato Chips Industry Share

#Potato Chips Industry Size

#Pizza Box Industry

#Pizza Box Industry Share

#Pizza Box Industry Size

#Pizza Box Industry Demand

#Pizza Box Industry Growth

#Collagen Peptide Industry

#Collagen Peptide Industry Share

#Collagen Peptide Industry Size

#Collagen Peptide Industry Demand

#Collagen Peptide Industry Growth

#Smoothie Industry

#Smoothie Industry Analysis

#Smoothie Industry Opportunities

#Smoothie Industry Forecast

#Smoothie Industry Size

#Smoothie Industry Share

#Smoothie Industry Growth

#Amaranth Industry

#Amaranth Industry Size

#Amaranth Industry Share

#Amaranth Industry News

#Ginger IndustryGinger Industry

#Ginger Industry Growth

#Green Tea Industry Growth

#Pet Food Industry News

#Pet Food Industry Trends

#Pet Food Industry Insights

Archives

The Future Outlook of the Pet Food Industry

-

Posted by preeti mmr Filed in Other #Pet Food Industry #Pet Food Industry News #Pet Food Industry Trends #Pet Food Industry Insights 39 views

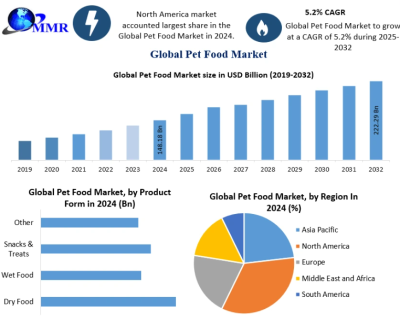

The Pet Food Industry, valued at approximately USD 148.18 billion in 2024, is forecast to grow at a compound annual growth rate (CAGR) of 5.2% from 2025 to 2032, reaching nearly USD 222.29 billion by 2032. This trajectory reflects evolving consumer preferences, innovations in product formulation, and changing dynamics in pet ownership.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/21009/

Market Estimation & Definition

Pet food refers to food specially formulated for pets such as dogs, cats, birds, and other companion animals. These formulations take into account life stage, breed, health condition, and often include various product forms such as dry food (kibble), wet food (canned or pouch), snacks & treats, and “other” specialty types.

The market analysis spans historical data from 2019–2024 and provides forecasts through 2032, covering both value (USD) and volume. Key segments include product type, pet type, ingredient source, and distribution channel. Geographically, it includes North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Market Growth Drivers & Opportunities

-

Humanization of Pets

Pets are increasingly seen as family members, pushing demand for high-quality, tailored, and premium food products. Pet owners want nutrition, health benefits, transparency, and indulgent treats aligned with their own lifestyle choices. -

Focus on Health and Wellness

Growing awareness of pet health—covering obesity, allergies, digestive wellness, and aging—has led to demand for specialized diets, reduced artificial additives, high-protein and fiber-rich options, and therapeutic formulas recommended by veterinarians. -

Sustainability and Ethical Sourcing

Consumer preferences are shifting toward environmentally friendly ingredients, recyclable packaging, and ethically sourced proteins. This has opened opportunities for plant-based, insect-based, and alternative protein pet foods. -

Product Innovation in Premium Segments

Innovations such as grain-free, organic, life-stage-specific, breed-specific, and functional foods are gaining traction. Fresh, frozen, air-dried, and freeze-dried foods are seeing rapid adoption among urban and health-conscious pet owners. -

Shift in Distribution Channels

While supermarkets and pet specialty stores remain dominant, e-commerce, subscription services, and direct-to-consumer sales are rapidly expanding. Online channels allow for broader product variety, home delivery, and personalized purchase options. -

Rising Pet Ownership Worldwide

Urbanization, smaller households, and higher disposable incomes are contributing to increased pet adoption in emerging economies, thereby expanding the base of pet food consumers.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/21009/

Segmentation Analysis

The pet food market can be segmented across multiple dimensions, each with distinct trends:

-

By Product Type:

Dry food continues to dominate due to convenience, cost efficiency, and long shelf life. Wet food is valued for its palatability and hydration benefits, often preferred for cats and senior pets. Snacks & treats are fast-growing, reflecting both functional (dental, digestive health) and indulgent purposes. Other products, including freeze-dried and hybrid forms, represent emerging niches catering to premiumization and innovation. -

By Pet Type:

Dogs and cats are the largest consumers of pet food globally. Dogs account for a significant share due to higher consumption per pet, while cats are gaining traction with urban households, particularly in Europe and Asia. Other pets, including birds, fish, and small mammals, represent a smaller but steady market segment. -

By Ingredient Source:

Animal-derived ingredients remain the most common, offering high protein content and palatability. However, plant-based and alternative proteins (such as insect protein) are gaining interest, supported by sustainability concerns and dietary preferences of younger consumers. -

By Distribution Channel:

Supermarkets & hypermarkets drive volume sales due to accessibility, while pet specialty stores remain strong for premium and specialized options. Veterinary clinics are trusted outlets for therapeutic diets. E-commerce and subscription models are the fastest-growing, favored by tech-savvy and convenience-oriented consumers. -

By Geography:

The market spans North America, Europe, Asia Pacific, the Middle East & Africa, and South America, each with unique demand patterns, regulations, and growth rates.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/21009/

Country-Level Analysis

United States

The U.S. remains the largest single market for pet food, estimated at over USD 43 billion in 2024. Key growth factors include the rising demand for premium and organic pet food, fresh and freeze-dried product innovation, and the dominance of e-commerce platforms. Dry food leads in volume, but wet food and treats are gaining fast in value share. Strong brand loyalty, transparent labeling, and sustainable packaging are increasingly influencing purchase decisions.

Germany

Germany is a leading European pet food market, with retail sales exceeding €4 billion in 2024. Cat food, particularly dry formulations, is showing strong growth, while dog food is more stable with treats being a resilient category. German consumers place high emphasis on organic certification, natural ingredients, and eco-friendly packaging. The country also demonstrates robust growth in online sales, with specialty brands leveraging direct-to-consumer models.

Key Players:

1. Mars Petcare

2. Nestlé Purina Petcare

3. Hill’s Pet Nutrition

4. General Mills

5. The J.M. Smucker Company

6. Diamond Pet Foods

7. United Petfood

8. Freshpet

9. Wellness Pet Food (WellPet)

10. Orijen

11. Acana (Champion Petfoods)

12. Merrick Pet Care

13. Taste of the Wild

14. Farmina Pet Foods

15. Royal CaninConclusion

The global pet food market is entering a period of strong growth and transformation, projected to expand from USD 148.18 billion in 2024 to USD 222.29 billion by 2032. Consumer expectations around pet health, nutrition, sustainability, and convenience are reshaping the industry.

The U.S. and Germany highlight contrasting but complementary market dynamics: while the U.S. shows strength in innovation and premiumization, Germany emphasizes sustainability and organic preferences. Both markets, however, point toward a shared global trend—pets are no longer just companions, but family members, and their nutrition is a reflection of consumer values.

About UsMaximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.Contact Maximize Market ResearchMAXIMIZE MARKET RESEARCH PVT. LTD.2nd Floor, Navale IT park Phase 3,Pune Banglore Highway, NarhePune, Maharashtra 411041, India.+91 9607365656sales@maximizemarketresearch.com -