Chickpea Flour Market Trends, Size, Top Leaders, Future Scope

-

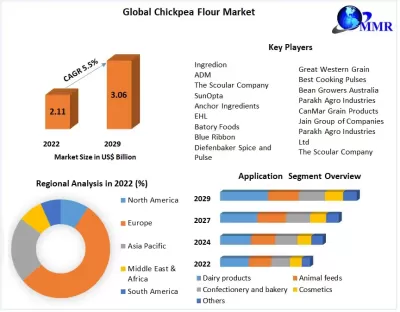

Chickpea Flour Market size was valued at USD 2.11 Bn. in 2022 and the total Chickpea Flour Market revenue is expected to grow at 5.5 % from 2023 to 2029, reaching nearly USD 3.06 Bn

Market Size

- 2024 Estimated Value: USD 2.5 billion

- 2034 Forecast: USD 4.9 billion

- CAGR (2024–2034): ~6.9%

Overview

Chickpea flour—made from finely milled chickpeas—is a protein‑rich, gluten‑free, and fiber‑dense alternative to wheat flour. Popular in plant-based and functional food products, it’s widely used in baking, snacks, batters, beverages, and dairy alternatives. Nutritious, versatile, and clean‑label, it appeals strongly to health‑conscious consumers in both retail and foodservice channels.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/75467/

1. Market Estimation & Definition

Market structure defined by:

- By Type: Kabuli chickpea flour (larger, lighter seeds) and Desi chickpea flour (smaller, darker grains)

- By Product Claim: Organic / Non‑GMO and Conventional

- By Application: Food & Beverage, Animal Feed, Cosmetics & Personal Care (dairy-related applications among fastest growth)

- By Distribution Channel: Offline (supermarkets, hypermarkets, specialty stores) and Online

- By Region: Asia‑Pacific, North America, Europe, Latin America, Middle East & Africa

2. Market Growth Drivers & Opportunity

- Plant-Based and Gluten-Free Movement: Rising popularity of gluten‑free, vegan, and protein‑rich products globally.

- Nutritional Benefits: High levels of protein, fiber, iron, magnesium, and folate support strong positioning in health-conscious diets. ([turn0reddit13])

- Clean-Label Demand: Organic and non‑GMO chickpea flour represents over 87% of global sales, especially in North America and Europe.

- Innovation in End-Uses: New applications in beverages, dairy-free products, confectionery, and dietary supplements.

- Regional Cooking Culture: Strong legacy use of chickpea flour in traditional diets (e.g. South Asian, Mediterranean) fueling market base.

- Retail Penetration: Supermarkets and health food chains expanding stock; online platforms offer specialty brands with convenience and visibility.

3. Segmentation Analysis

- By Type Segment:

- Desi chickpea flour dominated ~62.7% share in 2024;

- Kabuli chickpea flour is growing steadily (~5.5% CAGR) due to nutritional advantages. ([turn0search1], [turn0search3])

- By Application:

- Food & Beverage accounted for nearly 49% of usage and is the fastest‑growing segment;

- Dairy-related and bakery/confectionery applications (e.g. confectionery, batters) show strong growth.

- By Distribution Channel:

- Supermarkets/hypermarkets hold the largest share (~35%+);

- Online sales are expanding rapidly (~8.9% CAGR) due to e‑commerce convenience.

4. Major Manufacturers

The competitive landscape features both global and regional players including:

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- AGT Food and Ingredients

- The Hain Celestial Group

- Regional pulse processors (especially in India)

These firms focus on clean-label formulations, organic credentials, diverse application development, and global distribution networks. ([turn0search7])

Get More Info: https://www.maximizemarketresearch.com/request-sample/75467/

5. Regional Analysis

- Asia‑Pacific: Largest share (~48% of global market in 2024), estimated to grow from USD 1.49 billion in 2024 to USD 2.34 billion by 2030 at ~7.8% CAGR. This region leads both production and consumption. ([turn0search2])

- North America: Market size around USD 775 million in 2024; expected to reach ~USD 1.19 billion by 2030 (~7.4% CAGR), driven by gluten-free and plant-based demand. ([turn0search9])

- Europe & Middle East/Latin America/Africa: Europe follows North America in growth; Middle East & Africa show rising traditional and health-based demand; Latin America emerging with culinary and functional adoption. ([turn0search6])

6. Country-Level Analysis (USA & Germany)

- United States: A leading single-country market (~44% share of North America), with strong demand for plant-based, gluten‑free products and clean-label ingredients across retail and foodservice. Emerging applications include protein snacks and specialty bakery uses.

- Germany: A key European hub where gluten-free baking, vegan trends, and innovation in alternative flours support high per-capita usage. Desi-type chickpea flour usage is rising in local and ethnic cuisines.

7. COVID‑19 Impact Analysis

Pandemic disruptions in 2020 caused initial supply chain and production slowdowns. However, lockdown-era home cooking, health-focused diets, and plant-based purchasing preferences accelerated off‑take. Online distribution and freezer/snack innovation in chickpea‑based products rebounded strongly from late 2020 onward.

8. Commutator (Competitive) Analysis

Market Structure: Moderately fragmented—mix of large multinationals and regional producers. Notable competition from other plant‑based flours like pea, soy, lentil.

Competitive Trends:

- Premium organic/non‑GMO lines commanding price and loyalty

- Innovation in pre‑blended mixes, roti/batter mixes, gluten‑free bakery kits

- Foodservice partnerships for menu innovation (e.g. hummus‑based snacks)

- Vertical integration by pulse producers to direct‑sell into retail channels

Challenges:

- Price fluctuations due to crop yields and weather-sensitive supply

- Competition from alternative pulse flours offering similar nutrition and price advantages ([turn0search10])

- Consumer education needed: differentiating Kabuli vs Desi vs “besan” and recipe adaptation

Opportunities:

- Expansion of health and protein snack categories using chickpea flour

- Growth in nutraceutical and functional ingredient segments

- Collaboration with food-tech start-ups to launch new formats (e.g. chickpea‑based pasta, frozen waffles)

- Supply diversification to mitigate climate or trade disruption risks

9. Key Questions Answered

Question

Answer

Global market size in 2024?

USD 2.5 billion

Forecast size by 2034?

USD 4.9 billion

CAGR (2024–2034)?

~6.9%

Leading type segment?

Desi chickpea flour (~62.7%)

Fastest‑growing type?

Kabuli chickpea flour (~5.5% CAGR)

Dominant application?

Food & Beverage (~49%)

Leading distribution channel?

Supermarkets/hypermarkets (~35%+)

Fastest‑growing channel?

Online platforms (~8.9% CAGR)

Largest region?

Asia-Pacific (~48% share in 2024)

Fastest‑growing region?

Asia-Pacific (~7.8% CAGR)

Major companies?

ADM, Ingredion, AGT, Hain Celestial, others

10. Conclusion

The global chickpea flour market is on a robust growth trajectory, expected to nearly double over the next decade. Driven by rising gluten-free diets, plant‑based nutrition trends, clean‑label preferences, and rich cultural use in traditional cuisines, chickpea flour is establishing itself as a cornerstone ingredient in modern food systems. Asia‑Pacific leads both production and consumption, while North America and Europe offer strong premium markets. Manufacturers and retailers investing in organic certification, recipe innovation, and diverse formulations—while managing supply risk—will drive sustainable growth. With expanding applications in snacks, bakery, beverage, and health foods, chickpea flour is poised to remain a competitive force in global close‑label and functional food value chains.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com