Categories

Tags

-

#US Cards and Payments Market Share

#US Cards and Payments Market Trends

#US Cards and Payments Market Analysis

#United States Financial Services Market Share

#United States Financial Services Market Trends

#United States Financial Services Market Analysis

#Kenya HVAC Market Share

#Kenya HVAC Market Trends

#Kenya HVAC Market Analysis

#Senegal HVAC Market Share

#Senegal HVAC Market Trends

#Senegal HVAC Market Analysis

#Kuwait Chiller Market Share

#Kuwait Chiller Market Trends

#Kuwait Chiller Market Analysis

#Middle East & North Africa (MENA) Centrifugal Water Pumps Market Share

#Middle East & North Africa (MENA) Centrifugal Water Pumps Market Trends

#Middle East & North Africa (MENA) Centrifugal Water Pumps Market Analysis

Archives

United States Financial Services Market Forecast 2030

-

Posted by irene garcia Filed in Business #United States Financial Services Market Share #United States Financial Services Market Trends #United States Financial Services Market Analysis 175 views

Future of Executive Summary United States Financial Services Market: Key Dynamics, Size & Share Analysis

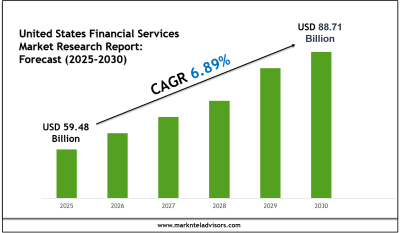

The United States Financial Services Market size was valued at around USD 59.48 billion in 2024 and is expected to reach USD 88.71 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.89% during the forecast period, i.e., 2025-30.

Top United States Financial Services Driver Impacting the United States Financial Services Market Growth

Increasing Digital Accessibility Driving Market Demand – The market growth is driven by the rising digital accessibility in the United States. For instance, 88% of Americans have access to the internet, and over 90% own a smartphone, contributing to the market growth, as people can easily use online and mobile banking services anytime, anywhere. This wide availability allows customers to open accounts, transfer money, apply for loans, invest, and buy insurance without visiting a physical branch. For example, apps like Chase Mobile, Venmo, and Robinhood have millions of users in the country who prefer managing their money digitally because it is fast and convenient. This is because features such as instant payments, mobile check deposits, and AI-powered chatbots make banking simpler and more personalized, enabling people in rural or underserved areas to benefit from digital services, helping increase financial inclusion. It has increased the availability of fully online financial services in the country. For instance, around 30 banks, such as Varo Bank and Chime, in the United States are fully online banks called neobanks, which are increasing market growth.

This high level of internet penetration and smartphone adoption fuels the demand for digital financial services, encouraging traditional banks and fintech startups to invest heavily in technology. As a result, digital accessibility is a key driver of growth and transformation in the U.S. financial services industry.

Unlock exclusive insights into the United States Financial Services Market – request your free sample PDF now and explore key trends, growth drivers, and competitive strategies shaping the industry - https://www.marknteladvisors.com/query/request-sample/us-financial-services-market.html

Understanding the Core Segments in the United States Financial Services Market

United States Financial Services Size, Share & Industry Trends Analysis - By Product Type (Banking Services [Retail Banking, Commercial Banking, Investment Banking, Private Banking, Digital/Neo Banking], Insurance Services [Life Insurance, Health Insurance, Property & Casualty Insurance, Auto Insurance, Specialty Insurance], Asset & Wealth Management [Mutual Funds, Pension/Retirement Funds, Private Equity, Hedge Funds, Robo-Advisory], Payments & Fintech [Credit Cards, Debit Cards, Mobile Payments, Digital Wallets, P2P Transfers, Buy Now, Pay Later], Lending Services [Mortgage Lending, Consumer Lending, SME Lending, Student Loans, Auto Loans], Capital Markets [Equity Markets, Fixed Income, Derivatives, Structured Products], Real Estate Finance, Crowdfunding, Crypto & Digital Assets), By Distribution Channel (Direct, Online/Digital Platforms, Mobile Applications, Agents/Brokers, Third-Party Aggregators, Others), By End-User (Individuals/Households, Small & Medium Enterprises, Large Enterprises, Government/Public Sector, Non-Profit Organizations) and Others

Geographical Analysis of the Open Banking Market

-By Region

- Northeast

- Midwest

- South

- West

Who Dominates the United States Financial Services Market Insights on Key Industry Players?

Companies are strengthening their presence in the United States Financial Services Market by adopting strategies such as forming strategic alliances, leveraging AI, entering partnerships, pursuing mergers and acquisitions, expanding into new regions, and introducing innovative products and services.

- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Citigroup Inc.

- Goldman Sachs Group, Inc.

- Morgan Stanley

- American Express Company

- Berkshire Hathaway Inc.

- Prudential Financial, Inc.

- MetLife, Inc.

- The Charles Schwab Corporation

- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings, Inc.

- Stripe, Inc.

- Others

Tap into future trends and opportunities shaping the United States Financial Services Market Download the complete report: https://www.marknteladvisors.com/research-library/us-financial-services-market.html

Why Choose This MarkNtel Advisors Research Report

- Comprehensive Insights – Offers a 360° view of the United States Financial Services, combining qualitative and quantitative analysis for a deep understanding of trends, drivers, challenges, and opportunities.

- Reliable Data Sources – Data is gathered through verified primary and secondary sources, ensuring accuracy and credibility.

- Actionable Forecasts – Advanced predictive modeling and time-series analysis provide practical insights to guide strategic decisions and business planning.

- Expert Analysis – Insights from industry experts help interpret complex United States Financial Services dynamics, delivering clarity beyond the numbers.

- Customized & Strategic Reporting – The report includes detailed charts, graphs, and strategic recommendations tailored to support business growth and investment decisions.

- Trusted Methodology – Built on rigorous research principles, including precise sampling, data validation, and forecasting techniques, reflecting the trust businesses place in MarkNtel Advisors.

"This report equips decision-makers with actionable intelligence, enabling them to navigate United States Financial Services complexities with confidence and foresight."

Gain exclusive access to our comprehensive insights on the Future of United States Financial Services Market. With tailored licensing options, including Mini Report Pack, Excel Data Pack, Single User, Multiuser, and Enterprise Packs, our research empowers organizations to navigate dynamic United States Financial Services trends effectively.

Select a License That Matches Your Business Requirements with Instant Offer - https://www.marknteladvisors.com/pricing/us-financial-services-market.html

About us:

We are top leading United States Financial Services research company in Noida, India and have our existence across the United States Financial Services for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Being one of the most efficient United States Financial Services research companies in India, our specialized team of experienced & efficient United States Financial Services research professionals is capable of grasping every minute and valuable information & data of the United States Financial Services to offer our clients with satisfactory details. Our company has served the biggest United States Financial Services research firms in India at leading positions and is proficient in managing all types of United States Financial Services research projects.

Trending blog:

- https://www.marknteladvisors.com/blogs/top-e-scooter-companies-in-thailand.html

- https://futureUnited States Financial Servicesresearchh.blogspot.com/2025/09/future-of-home-office-furniture-United States Financial Services.html

- https://futurereadyresearch.blogspot.com/2025/08/future-of-yoghurt-market-uae.html

- https://futurereadyresearch.blogspot.com/2025/08/future-of-preventive-cardiology-market.html

- https://futurereadyresearch.blogspot.com/2025/08/future-ifm-market-uae.html

- https://futurereadyresearch.blogspot.com/2025/08/future-of-the-saudi-arabia-cyber-security-market.html

- https://medium.com/@bhattsonu065/ai-agent-2025-market-size-future-trends-and-industry-impact-1c2696

- https://www.openpr.com/news/4166508/saudi-arabia-dates-market-value-to-reach-286-29-million-by-2030

- https://www.prnewswire.com/news-releases/ai-agent-market-forecast-to-reach-42-7-billion-by-2030-nor

Reach Us:

MarkNtel Advisors

Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

Visit our Website: https://www.marknteladvisors.com